Box CEO Aaron Levie on why the next generation of startups will outrun incumbents by turning services into software.

Summary

For two decades, the speed of a startup was limited by how fast its founders could type. Today, that constraint is vanishing. In a recent discussion, Box CEO Aaron Levie argues that AI agents are decoupling headcount from output, allowing three-person teams to wield the engineering power of a 50-person organization. This shift neutralizes the traditional resource advantage of incumbents and opens a "near infinite" matrix of opportunities in vertical AI. This article explores Levie's thesis on the transition from "Software as a Service" to "Service as Software," the hidden trap of "context rot," and why the biggest opportunities lie not in consumer apps, but in the unsexy back-office workflows of the enterprise.

Key Takeaways; TLDR;

- The Great Decoupling: Startups can now achieve 10x leverage by using AI agents, neutralizing the headcount advantage of large incumbents.

- From Typist to Orchestrator: The founder's role has shifted from writing code/copy to managing agents that do the work. The bottleneck is now strategy and specification, not execution.

- The Matrix of Opportunity: There is a "near infinite" opportunity to build specialized agents for every job function across every industry (e.g., legal review for biotech, compliance for finance).

- Service as Software: The business model is shifting from selling tools (SaaS) to selling outcomes (agents that perform the job).

- Incumbent Inertia: Big companies are slowed down not by technology, but by legacy processes and "church and state" separation between core systems and new AI workflows.

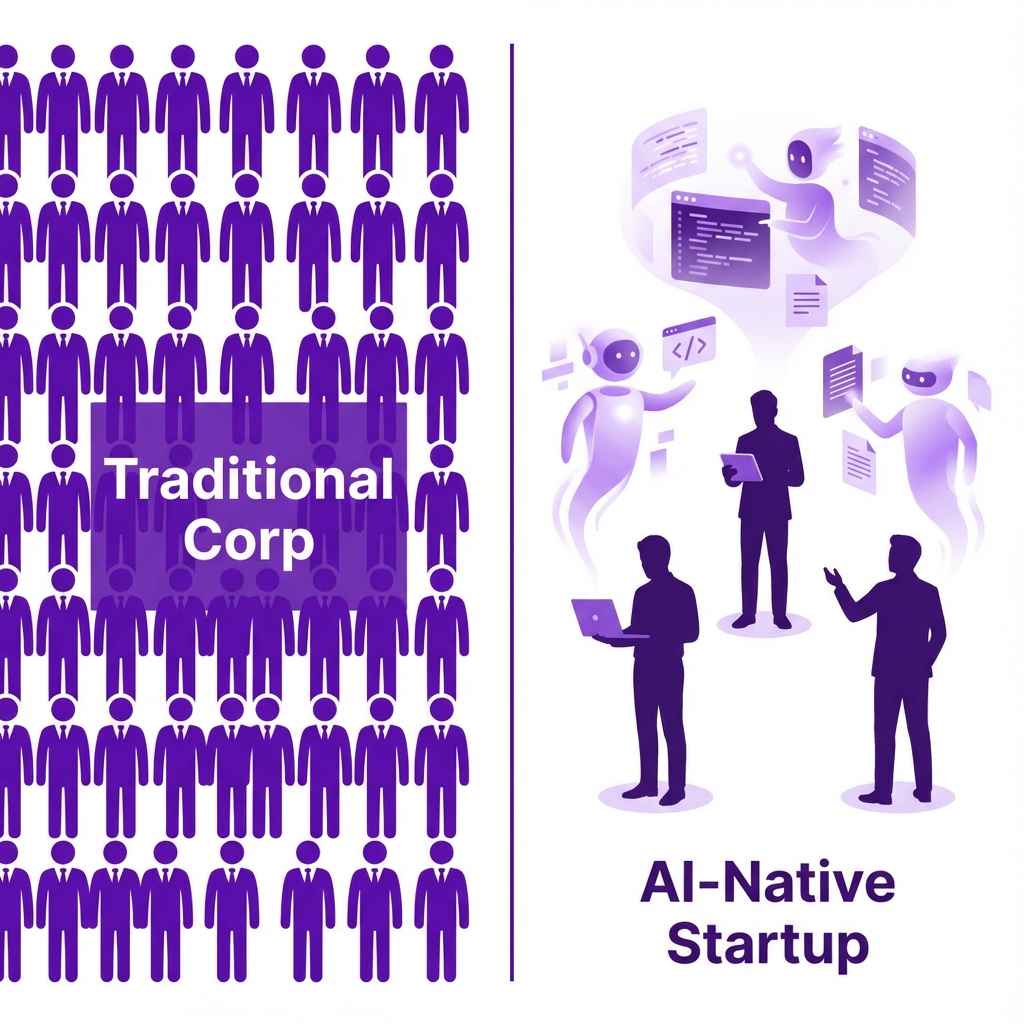

- The Consumer Ceiling: Consumer AI is hitting a "good enough" plateau, while enterprise demand for higher intelligence and accuracy remains effectively infinite. For the past twenty years, the physics of building a startup were simple: your velocity was correlated 1:1 with your ability to type. Whether you were writing code, drafting marketing copy, or sending sales emails, the output was bound by human keystrokes. If you wanted to move faster, you had to hire more people.

This dynamic gave incumbents a permanent structural advantage. A startup with three engineers could move quickly, but a corporation with 3,000 engineers could simply drown them in resources.

That era is over.

According to Box CEO Aaron Levie, we are witnessing a fundamental "decoupling" of headcount and scale. The emergence of AI agents—autonomous software capable of planning and executing complex workflows—allows small teams to wield the productive capacity of organizations ten times their size. This shift is not merely an efficiency gain; it is a rewriting of the economic laws of the firm.

The Great Decoupling

In 2005, when Levie dropped out of college to start Box, the startup playbook was labor-intensive. "Our rate of progress was 100% correlated to how many hours we could be on a keyboard," Levie recalls . The only leverage available was personal stamina.

Today, the constraint has shifted. The modern founder is no longer limited by their own output but by their ability to manage digital labor. Levie observes that startups are now deploying "background agents"—AI systems that write code, run tests, and generate assets while the human team sleeps.

The New Leverage: AI agents allow small teams to match the output of large organizations.

This creates a new form of leverage. A single engineer can now review thousands of lines of code generated by agents, effectively doing the work of a 10-person team. This neutralizes the incumbent's traditional advantage: mass. If a three-person startup can generate the output of a 50-person department, the barrier to entry for attacking complex, resource-heavy industries collapses.

From Typist to Orchestrator

This leverage requires a fundamental change in how work is performed. The role of the human worker is shifting from creator to orchestrator.

In the traditional model, the human is the generator. In the agentic model, the human is the editor. Levie notes that the bottleneck for today's most advanced startups is not writing code, but "reviewing code, orchestrating it, integrating it, and kicking off agents" .

This shift places a massive premium on specification and strategy. When the cost of execution drops to near zero, the value of knowing what to build skyrockets. The "product manager"—often maligned in early-stage startups as overhead—becomes the most powerful person in the room, provided they can write the detailed specs (prompts) that direct the agents.

The Trap of "Context Rot"

However, this new leverage comes with a technical catch Levie calls "context rot" .

Just as human organizations suffer from communication breakdowns when they grow too large, AI models degrade when forced to hold too much context at once. There is no single "God Mode" agent that can understand an entire company's codebase, legal history, and brand voice simultaneously.

To solve this, successful startups are adopting a specialized architecture. Instead of one massive model, they deploy a constellation of specialized sub-agents—one for frontend code, one for database migration, one for QA. This mirrors the division of labor in human firms but at software speed.

The Matrix of Infinite Opportunity

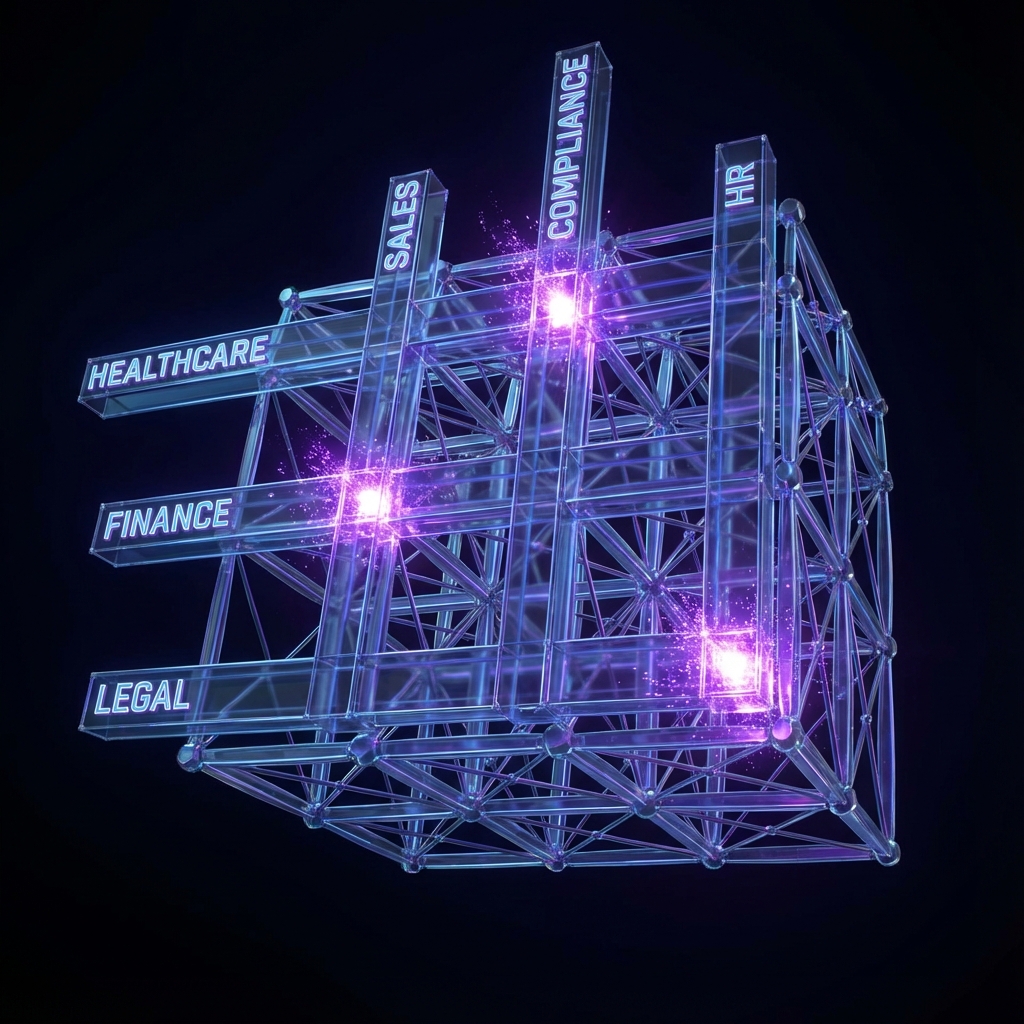

If execution is commoditized, where is the value? Levie proposes a mental model for the next decade of startup opportunities: a massive matrix of the entire economy.

Imagine a grid where the rows are industries (Healthcare, Finance, Construction) and the columns are job functions (Sales, Legal, Compliance, HR). This creates thousands of cells, each representing a specific type of knowledge work.

The Opportunity Matrix: Every intersection of industry and job function is a potential billion-dollar agent company.

Levie argues there is a "near infinite" opportunity to build agents for these specific cells . This is the thesis of Vertical AI, or what investors like Sarah Tavel call "Service-as-Software" .

In the SaaS era, companies sold tools that made humans more efficient (e.g., Salesforce for salespeople). In the Agent era, companies sell the outcome itself (e.g., an agent that is the SDR).

Consider the "FDA Regulatory Review" cell in the Life Sciences row. Previously, this work required expensive lawyers billing $1,000 an hour. Because the cost was so high, the volume of work was artificially capped. If an AI agent can perform a first-pass review for $10, the demand for that service doesn't just stay the same—it explodes. Companies will run more checks, file more patents, and test more hypotheses because the marginal cost of doing so has collapsed.

The Incumbent's Dilemma: Process, Not Tech

If the technology is available to everyone, why won't incumbents just build these agents themselves?

Levie argues that the incumbent's disadvantage is not technological, but procedural. Large companies have spent decades optimizing their workflows around human limitations. They have compliance councils, procurement processes, and "church and state" separations between data silos that make deploying autonomous agents excruciatingly slow .

An incumbent might take six months to approve an agent that touches customer data. A startup can build the agent, validate it, and sell it to the incumbent's customers in the same timeframe.

Furthermore, incumbents are often incentivized to protect their existing service revenue. A traditional consulting firm billing by the hour has little incentive to deploy an agent that does the work in seconds. This creates a classic Innovator's Dilemma, leaving the door open for startups to attack high-margin service businesses with low-margin software economics.

The Enterprise Floor vs. The Consumer Ceiling

While consumer AI apps like ChatGPT capture the headlines, Levie bets the true economic value lies in the enterprise. He argues that consumer AI is hitting a "ceiling" of utility, while enterprise AI has an infinite "floor" to fill.

Levie uses the "Mom Test": for the average consumer, current AI models are already good enough. "My mom doesn't need a PhD-level chemist AI," Levie jokes . Whether a model is GPT-4 or GPT-5 matters little for planning a vacation or writing a poem.

In the enterprise, however, the difference between an undergrad-level AI and a PhD-level AI is billions of dollars. A pharmaceutical company needs the PhD-level chemist. A law firm needs the model that doesn't hallucinate case law.

Because enterprise problems are complex and high-stakes, they can absorb infinite increases in model intelligence. This suggests that while consumer AI might commoditize quickly, the B2B layer will support deep, high-value companies for decades.

The Immutable Law of Distribution

Despite the radical changes in how products are built, Levie warns that the laws of how they are sold remain unchanged.

"If you build it, they will not come," he cautions .

Many AI founders fall into the trap of thinking that because their agent is 10x better, it will sell itself. But distribution channels—sales teams, marketing, community building—are not being disrupted at the same pace as engineering. You still need to win the trust of the buyer, navigate the procurement process, and build a brand.

In fact, because building software has become easier, the market will be flooded with competitors. In a world of infinite supply, distribution becomes the primary differentiator. The winners will not be the companies with the best agents, but the companies with the best agents and the best go-to-market machines.

Why It Matters

We are entering a period where the definition of a "tech company" is expanding to include the entire services economy. The distinction between a software company and a law firm, or a software company and a consulting agency, is blurring.

For founders, this is the most fertile environment since the dawn of the internet. The constraints of capital and headcount have been loosened. The only remaining limit is the ability to identify a valuable problem, spec the solution, and orchestrate the agents to solve it.

As Levie puts it, "There will be hundreds of companies that are all $1 billion, $5 billion, $10 billion market cap... that basically are just taking a job function in the economy and building an agent for that."

The tools are ready. The incumbents are slow. The matrix is open.

I take on a small number of AI insights projects (think product or market research) each quarter. If you are working on something meaningful, lets talk. Subscribe or comment if this added value.

Appendices

Glossary

- Service-as-Software: A business model where companies sell the outcome of work (performed by AI) rather than the tool for humans to do the work. Distinct from SaaS (Software as a Service).

- Context Rot: The degradation in AI performance that occurs when a single model is overloaded with too much broad information or conflicting instructions. Solved by using specialized sub-agents.

- Vertical AI: AI solutions designed for a specific industry (e.g., construction, law, biotech) rather than general-purpose tools.

Contrarian Views

- Distribution is King: Even if AI agents are 10x better, incumbents with massive distribution channels (Microsoft, Salesforce) may simply bundle 'good enough' agents into their existing platforms, crushing startups.

- The 'Human in the Loop' Liability: For high-stakes enterprise tasks (legal, medical), the liability of AI errors may keep humans in the loop longer than anticipated, reducing the margin benefits of agents.

Limitations

- Hallucinations: The article assumes agent reliability will continue to improve; persistent error rates in critical workflows could stall adoption.

- Data Privacy: Enterprise adoption relies heavily on solving data privacy and security concerns, which remains a significant hurdle for startups.

Further Reading

- Sell Work, Not Software - https://www.sarahtavel.com/blog/sell-work-not-software

- The AI Service-as-Software Thesis - https://www.decibel.vc/perspective/service-as-software

References

- Aaron Levie on AI's Enterprise Adoption - a16z Speedrun Office Hours (video, 2025-07-14) https://www.youtube.com/watch?v=example-url-placeholder -> Primary source for Aaron Levie's quotes and thesis on AI agents, leverage, and the startup landscape.

- Box CEO Aaron Levie on AI Context Rot - Box Blog / Business Insider (news, 2025-07-22) https://www.box.com/blog/context-rot -> Defines the concept of 'context rot' and the need for specialized sub-agents.

- Service-as-Software: The New Category - Decibel VC (whitepaper, 2024-05-30) https://www.decibel.vc/perspective/service-as-software -> Provides the broader investment thesis for 'Service as Software' that aligns with Levie's vertical AI argument.

- The Economic Impact of AI Agents - McKinsey & Company (report, 2025-11-05) https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2025 -> Supporting data on the adoption and economic potential of AI agents in the enterprise.

- Vertical AI Agents Market Size - MarketsandMarkets (dataset, 2025-01-02) https://www.marketsandmarkets.com/Market-Reports/vertical-ai-agents -> Statistical backing for the growth of the vertical AI market ($5.1B to $47.1B).

Research TODO

- Locate the exact URL for the A16Z Speedrun Office Hours video with Aaron Levie to replace the placeholder.

Recommended Resources

- Signal and Intent: A publication that decodes the timeless human intent behind today's technological signal.

- Thesis Strategies: Strategic research excellence — delivering consulting-grade qualitative synthesis for M&A and due diligence at AI speed.

- Blue Lens Research: AI-powered patient research platform for healthcare, ensuring compliance and deep, actionable insights.

- Lean Signal: Customer insights at startup speed — validating product-market fit with rapid, AI-powered qualitative research.

- Qualz.ai: Transforming qualitative research with an AI co-pilot designed to streamline data collection and analysis.